The total cost of a research project is the sum of the direct cost that can be specifically identified to the project plus the associated indirect cost. This graphic from COGR illustrates how indirect costs and direct costs together support sponsored research at universities nationwide.

Direct and indirect costs are distinguished by whether the cost can be identified with a particular sponsored project, not the nature of the cost.

Direct Costs

Direct costs are those that are easily attributable to individual grants. These costs can be identified with a particular sponsored project or can be assigned directly to such activities relatively easily with a high degree of accuracy.

-

- Salary support and benefits for faculty, research staff and postdocs working on the project

- Stipends for graduate students assigned to the project

- Laboratory supplies, chemicals, and glassware purchased for a project

- Travel to a conference to present results of the project

- Certain research equipment, including computers

- Publication costs

Indirect Costs

Indirect costs (also called Facilities and Administrative (F&A) costs) support the crucial research infrastructure that makes MIT a phenomenal environment in which to conduct research.

More specifically, indirect costs are a well-defined (and audited) set of costs incurred for common or joint objectives. These costs are necessary to perform research but are not exclusively related to a specific project.

-

- Building, maintaining, operating, and renewing research buildings and equipment

- Salary of a departmental administrator

- Library costs

- Depreciation of research equipment and buildings

- Laboratory utilities (light, heating/cooling, power)

- Hazardous chemical and biological agent management

- Internet

- Data transmission and storage

- Radiation safety

- Insurance

- Administrative systems and services

- Compliance with federal, state, and local regulations (e.g., Institutional Review Boards (IRBs) for human subject or animal research)

Understanding Indirect Costs at MIT

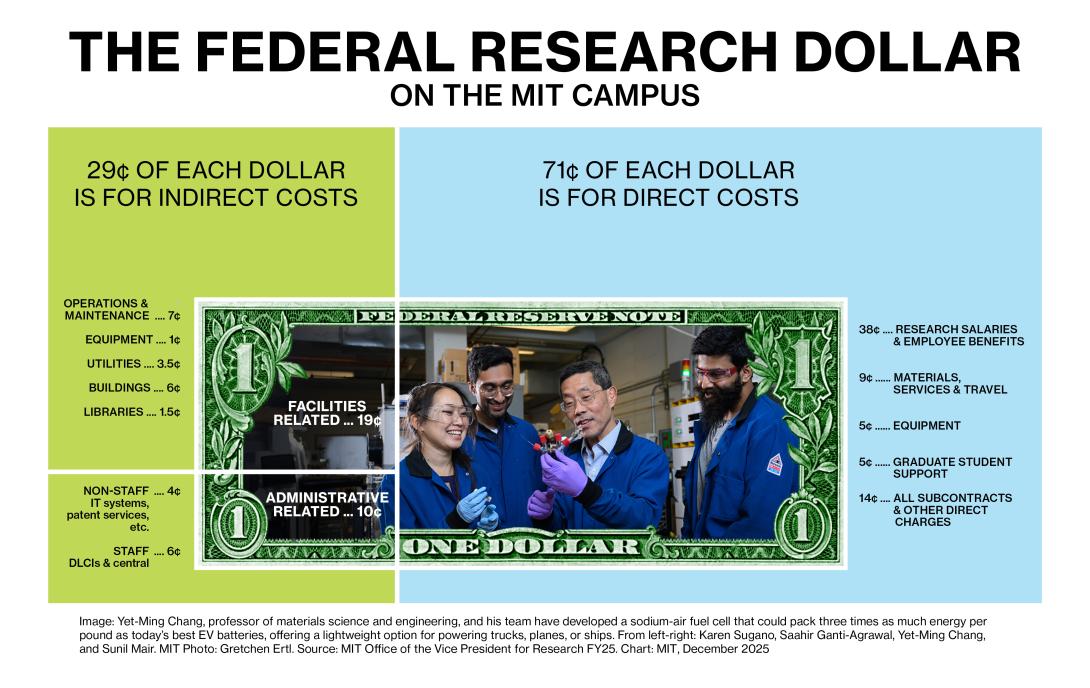

A project’s indirect costs are calculated using indirect cost rates. Using the federally negotiated indirect cost rate of 59% (FY25), for every $1.00 in direct costs, an organized research project also incurs $0.59 in indirect costs.

If the indirect cost rate were applied to every direct cost incurred by the project, indirect costs would make up about 37% of the project’s total costs ($0.59 divided by $1.59). However, some direct costs are excluded from the calculation of indirect costs. For a federal research project at MIT using an indirect cost rate of 59% during FY25, indirect costs accounted for 29% of the project’s total costs, on average. The presentation Research Costs at MIT [PDF] provides more details on how indirect and direct costs support the research enterprise.

Updated January 12, 2026